Open Online Casino

Africa is a hot topic in iGaming at the moment. Many operators are looking to establish a presence there, but which market offers the most potential for growth and profitability, and is the investment really worth the risk? Slotegrator sales manager Jashwant Patel, an expert on iGaming in Africa and Asia, sat down with Focus Gaming to discuss the topic.

Focus Gaming: You held a webinar on how to open an online casino in Africa. Can you give us an overview of online casino markets in Africa at the moment? Which are the strongest markets?

Jashwant Patel: The latest reports show that the top 6 African countries by overall GGR are South Africa, Morocco, Nigeria, Kenya, Egypt, and Ghana. The GGR of South Africa, which is the most economically developed country in the region, accounts for almost 50% of the whole continent. Nevertheless, online gambling accounts for only 7% of the country’s gambling sector. This demonstrates the huge potential for growth in the country, especially when local regulators remove the ban on online gambling, which is yet to come. In my opinion, progress on this front has likely been slowed by the pandemic.

With regards to online casino gaming, countries like Kenya, Nigeria, Ghana, Uganda, and Tanzania deserve some attention. Various forms of online gambling are legalized in all of them, with around 30% of bets being placed online, more than half of them via mobile devices.

Africa is developing rapidly, with a population growth of 2.7% each year. Cheap smartphones are becoming available to a wider range of people. Internet infrastructure is getting better, networks are covering more cities and towns each year, and more and more people can afford internet connections. All in all, there’s tremendous potential for online casinos.

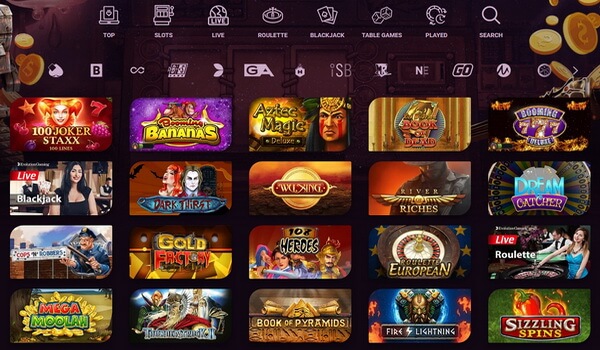

Before opening an online casino account, the first decision you have to take is deciding where you will play. For example, you might want to play at an online casino with a high average payout percentage, and you might wish to get the best terms on the sign-up bonus or want to play with an interface appealing to you. Starting an online casino requires you to take a series of essential steps. The fact is, there is no short cut to opening an online non UK casino. You have to go through all the required steps. Many people think that online casinos are challenging and complicated to open. In order to open a successful online casino that will benefit an owner and bring pleasure to customers, one needs to follow the proper sequence of steps paying serious attention to all details. As an online casino software provider, SoftSwiss is glad to share its experience to help future online casino owners avoid common mistakes that may. Playtech: Playtech is one of the world's leading online casino software providers and the only one currently listed on the London Stock Exchange.Founded in 1999, the company has continuously focused on state-of-the-art technology to ensure the best gaming experience for all. Playtech's software is available for all types of devices, so your casino will be covered across all options.

FGN: What are the biggest challenges that online casino operators face in African markets?

JP: I would name 3: players’ trust, internet speed and affordability, and instability in local regulations.

Most players are used to placing bets or playing casino games in retail shops. They may use an online version of a brand, but usually only after coming to trust retail versions. Therefore, for a brand without a retail presence, it’s really difficult to attract new players. However, there are exceptions, as always. One good example is Sportpesa.

Aside from the ones mentioned earlier, cheap mobile internet is yet to come to most African countries, so this is an issue as well. However, lots of players use retail shops to connect to Wi-Fi and place bets.

Connecting with Kenya: an overview of the Kenyan gambling market

Kenya is a multi-ethnic nation located in the African Great Lakes region. It has a population of approximately 47 million people and uses two official languages, English and Swahili. It’s the large...

Learn moreAnd last but not least, sometimes regulations in certain markets can be subject to unexpected changes. A good example would be the Kenyan BCLB introducing a 20% tax on bet amount, on top of the existing 15% tax on GGR. Everything has ended quite badly for project №1 in Africa, Sportpesa: the company’s gambling license was revoked in July 2019 and business had to be put on hold for a while. The situation is much more stable right now, as the 20% betting tax has been removed, but the incident did nothing to increase trust in local regulatory bodies.

FGN: How do customers in African markets differ from online casino customers elsewhere, and how would you compare the amount of investment needed?

JP: I would say African players prefer a simpler design. The gaming platform itself has to work smoothly on simple smartphones. Gaming platforms designed for European players won’t fit the African market. Simplicity, low data consumption, ease of player onboarding – these are 3 key factors that must be taken into account when building a project for the African market.

With regards to the amount of investment needed, it really depends on the individual market. No matter which market you want to enter, a close analysis is necessary; Africa is a very diverse continent. A strategy which works brilliantly in Kenya might be totally ineffective for nearby Uganda or Tanzania.

FGN: The webinar’s title is “Striking While the Iron Is Hot”. Why do you think that now is the time to enter African markets, and do you think competition is likely to increase sharply?

JP: To answer these questions, we can take a look at the European market. With internet infrastructure growing in the beginning of the 21st century, many European countries like Spain, Italy, and the UK saw the value in regulating online gambling. Doing so boosts the national budget, as well as supporting the development of sports and other social activities. Online GGR is growing each year, and soon will overcome land-based GGR, especially when we have COVID lockdowns every 2-3 months.

Bet on the future: Africa’s online gambling industry

Many leading iGaming operators now see Africa as a lucrative region to expand in. Thanks to their economic dynamism and enthusiasm for online sports betting, countries such as South Africa, Nigeria, and ...

Learn moreI think Africa, with its rapidly increasing internet connectivity, is at the start of the right path. Smartphones and 3g/4g networks have revolutionized the iGaming space in markets around the world, and Africa is following suit as more people are getting smartphone and internet access. Additionally, African countries have some of the world’s youngest populations, overlapping with the average age range of online casino players: 20-40. The overall GDP of the continent is growing along with its population, and GGR is growing right along with it. Forecasts for Kenya, Nigeria, and South Africa predict GGR growth on a year-by-year basis. It’s a good opportunity to enter the market at an early stage, before the level of competition is on par with more mature markets like Europe.

FGN: There are different regulatory regimes and even different situations regarding technological access across the continent. How do you think Africa will advance as an online casino market in the next few years?

JP: Countries with more developed economies are finding plenty of opportunities for investment. Chinese entrepreneurs are pouring money into projects and other ventures across the continent. One example is the Opay mobile payment start-up in Nigeria. Another Chinese company is the leading manufacturer of smartphones designed especially for African users.

Telecommunication infrastructure is going to evolve; consumers will have more opportunities to place bets with mobile internet and Wi-Fi becoming more accessible. Due to pandemic restrictions, more consumers will move online, as gambling is a part of everyday culture in some countries.

At the same time, the middle class is growing as well, so average bet levels have potential for growth. All told, an optimistic forecast is fitting. However, I would advise starting a sports betting and online casino platform, as for now, sports betting dominates the African online segment.

Open Online Checking Bank

If you are looking for an in-depth analysis of the African market, the recording of Jashwant’s webinar “Striking While the Iron Is Hot” is available for download. Jashwant covered specific markets like South Africa, Nigeria, and Ghana, as well as addressing the most frequently asked questions. Be sure to check it out if Africa is on your radar as a region for potential investment.

Own Your Own Casino